William Hecht

In 2006 I wrote a piece for this most august website titled "Welcome to the New Economic Order, Goodbye Pluto." The point of the piece was that in the face of the 2002 capital-spending recession we had had relied upon a very fast-acting and effective means of regenerating economic growth, namely "Wealth-Effect economic growth through asset inflation. " The idea is simple enough: you drive up asset prices by forcing people (rational economic actors are "forced" for our purposes) to invest in risky assets due to negative real interest rates. The money will stream out of savings or cash into commodities, stocks, and perhaps real estate in search of a return. These rising asset prices create wealth and the "wealth effect" changes perceptions and spending/consumption patterns in a positive way resulting in GDP growth - which complements the process. And it worked rather quickly and well for several years. That is until the wealth-effect began to operate in reverse in the face of rapid deflation as credit collapsed. That movie was Nightmare on Wall Street.

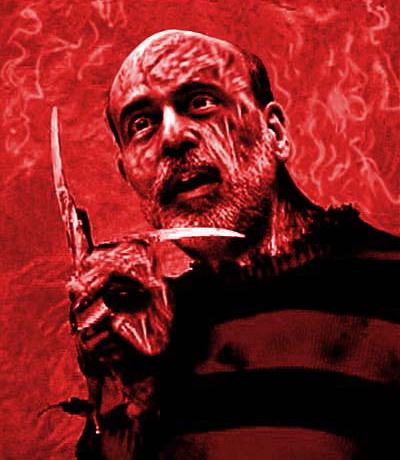

In 2006 I wrote a piece for this most august website titled "Welcome to the New Economic Order, Goodbye Pluto." The point of the piece was that in the face of the 2002 capital-spending recession we had had relied upon a very fast-acting and effective means of regenerating economic growth, namely "Wealth-Effect economic growth through asset inflation. " The idea is simple enough: you drive up asset prices by forcing people (rational economic actors are "forced" for our purposes) to invest in risky assets due to negative real interest rates. The money will stream out of savings or cash into commodities, stocks, and perhaps real estate in search of a return. These rising asset prices create wealth and the "wealth effect" changes perceptions and spending/consumption patterns in a positive way resulting in GDP growth - which complements the process. And it worked rather quickly and well for several years. That is until the wealth-effect began to operate in reverse in the face of rapid deflation as credit collapsed. That movie was Nightmare on Wall Street.

The point of this piece is merely to express my astonishment at the fact that there's a sequel being filmed right now and the working title is Nightmare on Wall Street II: Benny's Back. As I watch the markets rise on what seems a tide of liquidity, with regular new near-term highs and every selloff repelled and repulsed, I remember very distinctly the sensation that drove me to write the original article. I concluded in 2006 that the markets could continue to rise in the face of that terrific buoyancy - but not forever and not without a price. And that is exactly why I am writing this one; once the proper catalyst arrives, we will experience a more severe downturn than we did the last time. This sequel will be more horrifying than the first. The worst nightmares are about a demon that won't die and we are trying to kill this demon (the original demon - a capital-spending recession) using the same methods we did last time, but now from a severely weakened state!

Wealth Effect economic growth can work for a while, but not forever and not without a price. In this rendition of the process, we have had to print and borrow much more money to merely keep chugging along. What will end this doomed experiment? --Rising commodities or interest rates? Global conflict? Or just an earnings reality-check? How long before it starts? –You should start looking for the trailers this summer.

Copyright © 2010 William Hecht

William Hecht is an Associate Professor of Finance for Western International University.

Scottsdale, AZ USA | Email

Nessun commento:

Posta un commento