Daily Bell

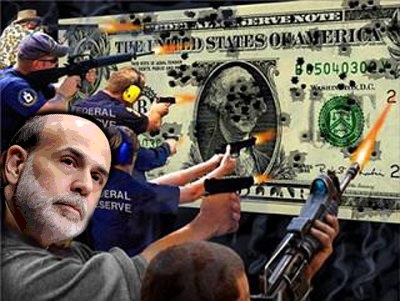

Ben Bernanke (left) needs fresh monetary blitz as US recovery falters ... Federal Reserve chairman Ben Bernanke is waging an epochal battle behind the scenes for control of US monetary policy, struggling to overcome resistance from regional Fed hawks for further possible stimulus to prevent a deflationary spiral. ... Fed watchers say Mr. Bernanke and his close allies at the Board in Washington are worried by signs that the US recovery is running out of steam. The ECRI leading indicator published by the Economic Cycle Research Institute has collapsed to a 45-week low of -5.7 in the most precipitous slide for half a century. Such a reading typically portends contraction within three months or so. Key members of the five-man Board are quietly mulling a fresh burst of asset purchases, if necessary by pushing the Fed's balance sheet from $2.4 trillion (£1.6 trillion) to uncharted levels of $5 trillion. But they are certain to face intense scepticism from regional hardliners. The dispute has echoes of the early 1930s when the Chicago Fed stymied rescue efforts. - UK Telegraph

Dominant Social Theme:

Bernanke struggles valiantly to hold the fort.

Free-Market Analysis:

The more arcane the language, the more opaque the actual stimulative occurrences, the less people understand. That's the point of course. The average person should know only that tremendous and substantive efforts are being made by extremely intelligent people to avert economic disaster. This is a dominant social theme: "The powers-that-be are working hard on your behalf using intricate central banking procedures to ensure your welfare."

Let's dissect Federal Reserve actions to see if this is actually true. Once we have examined what is really going on, maybe we can draw some conclusions about what may happen next. Bear in mind all this is being written from the point of view of the current fiat money system as it configured via mercantilist, public-private central banks. A fiat money system is one where the link between an underlying commodity and paper money itself has been severed. This allows a public/private central bank to print just about as much money as central bankers wish to print.

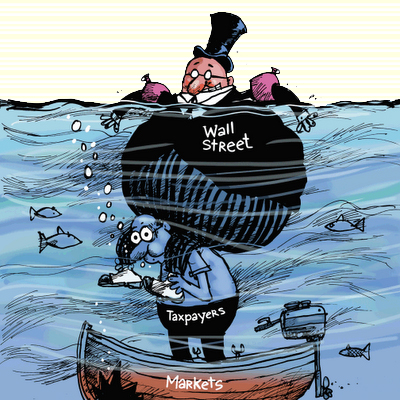

This system is the worst of all worlds, in our opinion. Using the rationale of maintaining an independent monetary policy, central bankers are relieved of scrutiny and oversight and print and distribute to whomever they wish to - usually other private, monied institutions. The ability to print and distribute billions and even trillions of dollars without scrutiny is one of the most bizarre and shocking aspects of this illegitimate (and in our opinion fraudulent) system.

In any event, the system is certainly firmly in place currently. And it has various controlling mechanisms. Central banks can add or subtract from the money supply, thus influencing the larger economy. Generally, central banks can print more or less money, raise or lower interest rates and add or subtract liquidity (money) from the larger economy using a variety of tools (discount window, etc.)

What happens in a very bad recession - this one being called the Great Recession - is that many of the tools that mercantilist central banks use to manipulate the economy cease to work. This comes about because the central banks in question have printed too much money (electronically and otherwise) and flooded the economy with currency that has caused first a boom and then a bust.

During the bust part of the business cycle, businesses and stock markets collapse because people have realized that the economy is over-extended and that many projects hitherto thought successful won't actually become viable or profitable. This has a ripple effect throughout the economy and prices, instead of heading higher start to head down. This is called deleveraging or price deflation.

Does the money circulation in the economy actually go away? This question has been a point of much debate and confusion within the alternative press. In fact, through workouts and bankruptcies, money (electronic and otherwise) may return to banks where it is then warehoused, not circulated, which would mean, essentially, that the supply of circulating money stock in the larger economy has been reduced. In a sense, this can be considered true deflation (as opposed to price deflation).

This contraction is mimicked as well among consumers who may choose not to circulate paper money and electronic money but to hoard it. During a Great Recession such as the one that the West faces now, money does not circulate freely even though there is a great deal of money within the economy. Bear in mind that it is not only central banks that create money. Credit card companies create money as do private and public business startups, IPOs, etc. But ultimately the initial money come from the central bank and is injected into the economy through its commercial banking disseminators.

The final reason that money does not circulate is because banks do not want to lend. Usually at such times banks are under a lot of pressure to build up their balance sheets, which they do by keeping money rather than lending it and by calling in speculative loans. Also, in the modern era of bailouts, governments tend to prop up failing companies so banks cannot even tell a healthy company from a sick one that will sooner or later go out of business. This also retards the process of money circulation.

Once money has ceased to circulate freely because of the above reasons, the economy itself begins to wind down. Central banks can print more money and urge banks to lend, but in a bad recession or in a depression it is very difficult to start money flowing again until the economy has in a sense cleansed itself and is ready to begin to grow once more.

This is where the larger Western economy is right now, in fact - in a place where money is NOT circulating freely. Central banks have cut interest rates to zero and have begun programs of quantitative easing, which means that central banks are buying (debt) instruments in the open market in the hopes of stimulating growth by adding circulating money to the money supply.

So why isn't it working? Because central banks (the Federal Reserve in particular) are focused only injecting money via large financial institutions and banks. This is a control mechanism. If central banks were to send money to individual entrepreneurs, then citizens would begin to see how farcical the system really is.

In fact, as we have pointed out many times before, the system itself is set up to mimic a real monetary system but it is no such thing. A real monetary system using gold and silver needed bank/warehouses for purposes of money metals storage. But today, banks are merely distribution points and ways to ensure that the flow of money is controlled by the proper gatekeepers. This is why, in fact, deflation is such a problem in a fiat money economy. In a real economy, deflation is a good thing, but in a fiat economy, deflation, at least to some extent, adds insult to injury.

The article which we have excerpted has a telling quote toward the bottom, as follows: "Gabriel Stein, from Lombard Street Research, said the US is still stuck in a quagmire because Mr Bernanke has mismanaged the quantitative easing policy, purchasing the bonds from banks rather than from the non-bank private sector." This is our point exactly. Bernanke will do ANYTHING but distribute money directly to the private sector where it would actually be put immediately to good use and would CIRCULATE.

Thus we see that central banking is not just about trying to control the economy; it is also about giving people a sense that the economy RUNS through banking entities. It is an actionable element of the dominant social theme we referred to at the beginning of this article. Only the smartest of people get to touch the new money, and they must distribute it judiciously. As much as Bernanke, et. al. would like to stimulate the economy, they will not do so by putting money directly into circulation. They will only use channels of authority and control.

The current Western fiat money system is an obscene, impoverishing disgrace. But what is even worse is that central banking authorities would rather let the world slide into an even more terrible financial crisis than to bypass banking and financial channels. Sooner or later there will be inflation, perhaps hyperinflation. There is simply too much money sloshing around in the system. But in the meantime, there will be more debt, less money and ... continued deleveraging.

Conclusion:

Central bankers are actually a quite dramatic breed. They don't seem to be play-acting, but they are. And they will surely continue to cry out loud - to wail and moan - about the dangers of fiat-money deflation. At the same time, they will never, ever let average people get their hands on freshly printed money that could alleviate some of the damage they has been wrought by this horrid system. And thus ... a second "recessionary" wave. That's indeed what may happen next. And Bernanke will continue to whine.

The dire straits of the middle class of America has made it near impossible for our politicians to keep up the pretense that our current government truly works for the "people." Between the multiple overt and

The dire straits of the middle class of America has made it near impossible for our politicians to keep up the pretense that our current government truly works for the "people." Between the multiple overt and  RBS tells clients to prepare for "monster" money printing by the Federal Reserve ... As recovery starts to stall in the US and Europe with echoes of mid-1931, bond experts are once again dusting off a speech by Ben Bernanke (Left) given eight years ago as a freshman governor at the Federal Reserve. Entitled "Deflation: Making Sure It Doesn't Happen Here", it is a warfare manual for defeating economic slumps by use of extreme monetary stimulus once interest rates have dropped to zero, and implicitly once governments have spent themselves to near bankruptcy. The speech is best known for its irreverent one-liner: "The US government has a technology, called a printing press, that allows it to produce as many US dollars as it wishes at essentially no cost." Bernanke began putting the script into action after the credit system seized up in 2008, purchasing $1.75 trillion of Treasuries, mortgage securities, and agency bonds to shore up the US credit system. He stopped far short of the $5 trillion balance sheet quietly pencilled in by the Fed Board as the upper limit for quantitative easing (QE). Investors basking in Wall Street's V-shaped rally had assumed that this bizarre episode was over. So did the Fed, which has been shutting liquidity spigots one by one. But the latest batch of data is disturbing.

RBS tells clients to prepare for "monster" money printing by the Federal Reserve ... As recovery starts to stall in the US and Europe with echoes of mid-1931, bond experts are once again dusting off a speech by Ben Bernanke (Left) given eight years ago as a freshman governor at the Federal Reserve. Entitled "Deflation: Making Sure It Doesn't Happen Here", it is a warfare manual for defeating economic slumps by use of extreme monetary stimulus once interest rates have dropped to zero, and implicitly once governments have spent themselves to near bankruptcy. The speech is best known for its irreverent one-liner: "The US government has a technology, called a printing press, that allows it to produce as many US dollars as it wishes at essentially no cost." Bernanke began putting the script into action after the credit system seized up in 2008, purchasing $1.75 trillion of Treasuries, mortgage securities, and agency bonds to shore up the US credit system. He stopped far short of the $5 trillion balance sheet quietly pencilled in by the Fed Board as the upper limit for quantitative easing (QE). Investors basking in Wall Street's V-shaped rally had assumed that this bizarre episode was over. So did the Fed, which has been shutting liquidity spigots one by one. But the latest batch of data is disturbing. After the great gold bug victory of the 1970s, the economic establishment had been humiliated and disgraced. This was because none of them knew any economics. They all had gotten their fancy titles and positions by apologizing for the bankers' privilege to create money. The bankers (and their associated vested interests) got rich. The American people got poor. (This is the first generation of Americans poorer than their parents.) And so it paid off for the bankers to hire a gang of charlatans, buy them fancy titles and infiltrate them into prestigious positions in academia so that they could use their prestige to defend the bankers' privilege to create money.

After the great gold bug victory of the 1970s, the economic establishment had been humiliated and disgraced. This was because none of them knew any economics. They all had gotten their fancy titles and positions by apologizing for the bankers' privilege to create money. The bankers (and their associated vested interests) got rich. The American people got poor. (This is the first generation of Americans poorer than their parents.) And so it paid off for the bankers to hire a gang of charlatans, buy them fancy titles and infiltrate them into prestigious positions in academia so that they could use their prestige to defend the bankers' privilege to create money. Howard S. Katz

Howard S. Katz