Few would argue with the notion that many aspects of life have pendulum-like properties. Markets and social moods, for example, might swing for a while in one direction, but more often than not, they eventually head back the other way.

Few would argue with the notion that many aspects of life have pendulum-like properties. Markets and social moods, for example, might swing for a while in one direction, but more often than not, they eventually head back the other way.

The mistake that people make, however -- and I am occasionally guilty of this as well -- is to assume that they know just when the transition point will be or has been reached, maybe because they've studied past patterns.

While that knowledge would no doubt be useful in a setting where only the laws of physics apply, it is not quite the same when the trend itself can influence people's behavior in ways that can affect its intensity and duration.

The classic example, of course, is a stock market bubble, where the pattern of price changes and natural herding instincts lead people who might not otherwise care about equities to dive in and buy with both hands, without thinking things through. Under those circumstances, the trend can extend well beyond what many believe is rational.

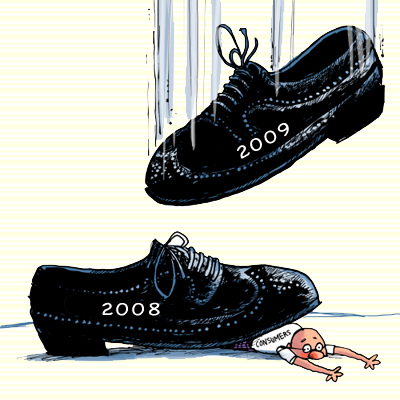

Applying similar logic to current circumstances, even if you take it as a given that severe recessions are followed by dramatic rebounds, it begs the question: can we assume that the downturn is fully played out, especially in light of reports and other evidence that people are (still) altering their behavior (e.g., spending less and saving more) in response to what's going on around them?

And even if you leave that issue aside, there are still plenty of nasty structural imbalances, many of which had a direct hand in causing the crisis, that have not been fully or even partially resolved and which could still cause plenty of damage to the economy and the markets.

There is also the possibility of an unexpected shock, as Bloomberg/BusinessWeek columnist William Pesek ponders in "Black Swans Abound as Year of Tiger Shows Teeth":

After a miserable year, 2010 has to be better, right? Think again

If many of us could have turned around the moment we entered 2010 and made obscene gestures at 2009, we would have.

After the wreckage of the past 12 months, 2010 has to be a good year, right? Good for governments staving off financial chaos, good for households struggling to stay afloat, good for investors wondering which rules of economics and markets still apply. It really is hard to see this year outdoing the last one in the doom-and-gloom department.

Yet the Year of the Tiger might live up to its name and be a fierce one. Here are five reasons why it may come with its share of sharp teeth and "Black Swans."

1. The bill for 2009 is coming due. Look no further than Japan, which has little to show for the hundreds of billions of dollars it's throwing at the economy. Deflation is intensifying, unemployment is worsening, the ranks of the working poor are growing and Prime Minister Yukio Hatoyama is anything but focused on these fast-mounting challenges.

Now, he faces the hangover from the 2009 borrowing binge. His 2010 budget won't rein in deficits that threaten Japan's Aa2 rating at Moody's Investors Service. The plot thickens when you add a shrinking population and tax base. That's why the cost of a five-year contract to protect $10 million of Japan's sovereign bonds has climbed to $68,650 from $37,000 in August, when Hatoyama's Democratic Party of Japan won power.

Japan is hardly alone. Governments are pouring untold trillions of dollars into economies financed with fresh bond issuance. The debt glut is as unprecedented as it is unsustainable. Expect credit-rating companies and investors to be sniffing around for potential debt crises, be they in China, Greece, Japan or Vietnam.

2. Global demand remains elusive. Singapore, where gross domestic product shrank in the final three months of 2009 - the first time in three quarters - tells the story. It's on the front lines of global trade and the annualized 6.8 percent drop in growth last quarter is an ominous sign.

China's almost 10 percent growth is helping commodity exporters such as Australia. Not so for the rest of Asia as it tries to fill the void left by a hobbled $14 trillion U.S. economy. An undervalued currency greatly limits the spillover benefits of China's stimulus efforts.

Skepticism is being voiced by leading economists on different ends of the ideological spectrum. Conservative Martin Feldstein, of Harvard University, and liberal Joseph Stiglitz, of Columbia University, say growth may falter as stimulus wanes. Just ask Singapore how U.S. frugality is working out for Asia.

3. Trade tensions will explode. Expect China's peg to the dollar to become even more of an issue as unemployment rates rise from Washington to Berlin.

The recent breakdown of climate-change talks in Copenhagen dispels any optimism about multilateral cooperation. It's beggar-thy-neighbor time as global growth limps along, and no one plays the game better than China.

On Jan. 1, a free-trade agreement between China and Southeast Asia came into force. It consolidated a sixfold surge in economic activity over the past decade between countries representing a quarter of the world's population. Yet countries such as Indonesia are already concerned about lowering their guard against Asia's rising superpower. Expect fireworks.

4. Central bankers will be on the ropes. They must find exit strategies for their monetary largess as asset bubbles inflate. Tap on the brakes too much and markets might crash. Apply them too timidly and inflation may accelerate.

India is one case of monetary policy being behind the curve. Officials from Seoul to Hanoi also face balancing acts.

Central-bank independence is a concern. It's impossible politically to put rates back to reasonable levels anytime soon. They must try, though, and those efforts will make for a volatile year in Asian markets.

5. Black-Swan risks abound. Umar Farouk Abdulmutallab's attempt to blow up a plane over Detroit on Christmas Day is a reminder that terrorism can shake markets anytime. The assassination of a major world leader also would be an unexpected event with great impact.

Sovereign defaults can't be ruled out, and troubles in small economies such as Iceland or Dubai have a way of spanning the globe. A huge dollar rally or yen plunge could upset so- called carry trades and bring down a couple of hedge funds. A crash in gold or oil prices would do the same.

Perhaps Japan will get its act together and recover for real. Or maybe things will go the other way: a debt crisis in Japan, the U.S. or the U.K.

Markets are hardly discounting hyperinflation, hyperdeflation, a global pension crisis, a collapse of North Korea's repressive regime, social unrest in China or Iran, major earthquakes in Tokyo or California, or Somali pirates getting their hands on more than oil.

And, more basically, what if optimism that we dodged another Great Depression is hubris and markets tank anew? Treating the symptoms of the financial crisis isn't the same as removing the causes.

We have seen how the impossible has a way of becoming possible these last two years. The one ahead may hold its own surprises as the Chinese zodiac's tiger roars.

William Pesek is a Tokyo-based columnist for Bloomberg News, providing opinions and commentary on economics, business, markets, and politics throughout the region. His columns routinely appear in the International Herald Tribune, The Australian, The Straits Times, The Japan Times and many other publications around Asia and the globe. He writes a monthly column for Bloomberg Markets magazine and is a regular on Bloomberg Television. The opinions expressed are his own.

Nessun commento:

Posta un commento