Più di 22000 sono stati i morti ammazzati in Messico a causa del narcotraffico. Un esercito di 45000 uomini impiegati nella lotta al commercio di sostanze stupefacenti. Una rete che coinvolge più di 230 città americane. Più di 20 milioni di tossicodipendenti negli Stati Uniti. Costi in USA pari a 215 miliardi di dollari. Martin Woods, che tra il 2006 e il Continua a leggere…

Desperate and Blatant Manipulation

Dan Norcini

Monday must now be the new "Friday" when it comes to gold. Those of you who have been watching the gold price action over the last decade know what I am referring to. For those of you who are a bit newer to the gold game, Fridays, particularly after a payrolls report, have typically been the day on which gold was taken down by the bullion bank crowd to mess with the weekly chart and the technical picture.

Monday must now be the new "Friday" when it comes to gold. Those of you who have been watching the gold price action over the last decade know what I am referring to. For those of you who are a bit newer to the gold game, Fridays, particularly after a payrolls report, have typically been the day on which gold was taken down by the bullion bank crowd to mess with the weekly chart and the technical picture.

Last Monday saw gold put in a horrendous bearish downside reversal day which the bulls managed to negate the rest of the week by a sheer gritty determination not to run. Today (another Monday) we have an exact repeat of the same bullion bank tactic that they employed 7 days ago; to wit, a takedown after price took out last Friday's session high while gold mining stocks were also moving sharply higher. The result - an exact repeat of last Monday technically - another bearish outside reversal day on the daily chart. This coming on the heels of a brand new record high in Dollar terms at the London PM Fix ($1,261).

It is quite evident that the perma-bears at the Comex are determined to cap gold at $1,260. No one hits bids with the intensity that I saw this morning unless they are trying to take price lower. The reason is obvious - a closing push through $1262 and gold goes immediately to $1,280 - $1,285 garnering all the more headlines and casting more doubt upon the integrity of world's current monetary system, which is under extreme duress. What the bullion banks are attempting to do is to form a double top on the daily price chart - it really is that simple.

Some are pointing to the stronger dollar as the culprit behind the weakness in gold, but that is denying the obvious and grasping for an explanation. Bonds are shooting sharply higher today and even the Yen is stronger as once again risk is back in focus and investors are moving to safe havens. Under such a scenario, the very notion that gold would be sold off as a "risky" asset is laughable for its stupidity.

The fact is gold was sharply higher after the conclusion of the meaningless G20 summit which was nothing but a group of yakking heads talking to hear themselves saying something. Investors rightfully interpreted that as further confirmation that nothing serious was going to be done that would restore confidence towards paper currencies. They then bid the yellow metal higher which held its gains from overnight as it moved into New York trading and even added some. We are then to believe that investors had a sudden change of heart so much so that they immediately became convinced at mid-morning that gold was no longer worthy to be held but instead US paper Treasuries were much more to be desired? Based on what news, what report? Come on already - are there actually people out there who are so damn dense that they believe this nonsense? This is what an orchestrated takedown looks like, pure and simple.

My own view is that this will meet with as much success as the previous Monday's. Not a thing has changed in regards to the world's monetary system - nothing. We always have to respect the technical price action because today's markets are dominated by techies but those same technicals worked in favor of the bulls last week based on the price action Tuesday through Friday last week. They have to repeat their performance once again.

Let's see how support levels function tomorrow and Wednesday. Chalk up today for the history books and forget about it. What is more important now is whether the bulls will hang tough and refuse to run. If they do not run, bears will be forced to cover as they did last week. As I mentioned in this past weekend's analysis of the COT report, bears will have to force price down below $1233 on a closing basis to induce long side liquidation.

Inside the United States How Bad is it?

William (Bill) Buckler

It’s pretty bad. All of a sudden, the recovery has almost officially become "fragile" in the US. The official version was stated in the Fed’s press release following the FOMC meeting on June 22-23. "Financial conditions have become less supportive of economic growth on balance", they said. Indeed they have. A recent report from a department of the US Treasury shows just how bad they have become.

It’s pretty bad. All of a sudden, the recovery has almost officially become "fragile" in the US. The official version was stated in the Fed’s press release following the FOMC meeting on June 22-23. "Financial conditions have become less supportive of economic growth on balance", they said. Indeed they have. A recent report from a department of the US Treasury shows just how bad they have become.

Until this month, the Treasury was predicting that US funded debt would climb to $US 19.6 TRILLION by the end of fiscal 2019. That has been "revised". On June 4, the Treasury released a report to Congress stating that the climb to $US 19.6 TRILLION would take place by 2015, four years earlier. They also predicted that this would be 102 percent of US GDP by that time. As of June 23, with fiscal 2010 nearing the end of its third quarter, the Treasury’s "debt to the penny" stood at $US 13.042 TRILLION.

The report said that the debt would reach $US 13.6 TRILLION by the end of fiscal 2010 on September 30. If it does, it will have grown by $US 1.7 TRILLION in fiscal 2010. And there was more. The Treasury projects that "publicly traded debt", the debt held by entities outside the US government itself, will almost double from its present level of $US 7.48 TRILLION to $US 14 TRILLION by 2015.

Ten years ago, the US Treasury was talking about paying off ALL government debt by 2012. Five years ago, they were talking about returning to "balanced budgets" at or about that date and all talk of "reducing" debt had vanished. Look at what they are talking about now. As we said, it’s pretty bad.

"Greece On The Pacific":

That is the new description of the US state of California, once touted as the eighth largest economy in the world. California - the headline state, the biggest state in terms of its internal economy - is facing the necessity of budget cuts which make the ones undertaken by the European Club Med nations look benign.

Like most US states, California has a fiscal year which ends on June 30. Like ALL US states, California is barred by law from running a budget deficit. The problem is that California is staring at a $19 Billion "deficit" in the year which ends at the end of June and a $US 37 Billion deficit over the year that ends in June 2011. Given a budget of about $US 125 Billion, that’s a 2010-11 shortfall of almost 30 percent.

Almost all US states are in the same predicament, only the size differs. So far, their budget deficits have been papered over by Mr. Obama’s stimulus plan of 2009, but that money has mostly already been spent. Having built their "budgets" on the real estate bubble, their revenues are diving as their costs, especially for "social services" skyrocket. Almost every report on the fiscal carnage going on in the US states has a variation on this theme: "The US government will inevitably have to come to the rescue". If you think the recent EU "sovereign debt" bailout was big (and it was), wait until you see THIS one!

"Austerity" In The US Congress!:

The US "Jobs Bill", a scaled down version of President Obama’s 2009 $US 787 Billion "stimulus package", has hit the wall. The Democrats in Congress have been trying to pass it for months. The 2010 version is seen as "essential" as it includes an extension of weekly unemployment benefits for millions of Americans who have been out of work more than six months. On top of that, the 2010-2011 fiscal year budgets prepared by most of the 50 states built the federal money included in this bill into their calculations. On June 24, the bill did not receive the 60 votes necessary to prevent a Republican filibuster. With the latest failure to pass the bill, 1.2 million Americans are going to see their "jobless benefits" end by the end of the week and the states will NOT be getting the federal money they were counting on. For a US Congress to reject such a bill is unheard of. As we said, it’s pretty bad.

William (Bill) Buckler Captain of The Privateer email: capt@the-privateer.com

US Double Dip Depression

Daily Bell

Ben Bernanke (left) needs fresh monetary blitz as US recovery falters ... Federal Reserve chairman Ben Bernanke is waging an epochal battle behind the scenes for control of US monetary policy, struggling to overcome resistance from regional Fed hawks for further possible stimulus to prevent a deflationary spiral. ... Fed watchers say Mr. Bernanke and his close allies at the Board in Washington are worried by signs that the US recovery is running out of steam. The ECRI leading indicator published by the Economic Cycle Research Institute has collapsed to a 45-week low of -5.7 in the most precipitous slide for half a century. Such a reading typically portends contraction within three months or so. Key members of the five-man Board are quietly mulling a fresh burst of asset purchases, if necessary by pushing the Fed's balance sheet from $2.4 trillion (£1.6 trillion) to uncharted levels of $5 trillion. But they are certain to face intense scepticism from regional hardliners. The dispute has echoes of the early 1930s when the Chicago Fed stymied rescue efforts. - UK Telegraph

Dominant Social Theme:

Bernanke struggles valiantly to hold the fort.

Free-Market Analysis:

The more arcane the language, the more opaque the actual stimulative occurrences, the less people understand. That's the point of course. The average person should know only that tremendous and substantive efforts are being made by extremely intelligent people to avert economic disaster. This is a dominant social theme: "The powers-that-be are working hard on your behalf using intricate central banking procedures to ensure your welfare."

Let's dissect Federal Reserve actions to see if this is actually true. Once we have examined what is really going on, maybe we can draw some conclusions about what may happen next. Bear in mind all this is being written from the point of view of the current fiat money system as it configured via mercantilist, public-private central banks. A fiat money system is one where the link between an underlying commodity and paper money itself has been severed. This allows a public/private central bank to print just about as much money as central bankers wish to print.

This system is the worst of all worlds, in our opinion. Using the rationale of maintaining an independent monetary policy, central bankers are relieved of scrutiny and oversight and print and distribute to whomever they wish to - usually other private, monied institutions. The ability to print and distribute billions and even trillions of dollars without scrutiny is one of the most bizarre and shocking aspects of this illegitimate (and in our opinion fraudulent) system.

In any event, the system is certainly firmly in place currently. And it has various controlling mechanisms. Central banks can add or subtract from the money supply, thus influencing the larger economy. Generally, central banks can print more or less money, raise or lower interest rates and add or subtract liquidity (money) from the larger economy using a variety of tools (discount window, etc.)

What happens in a very bad recession - this one being called the Great Recession - is that many of the tools that mercantilist central banks use to manipulate the economy cease to work. This comes about because the central banks in question have printed too much money (electronically and otherwise) and flooded the economy with currency that has caused first a boom and then a bust.

During the bust part of the business cycle, businesses and stock markets collapse because people have realized that the economy is over-extended and that many projects hitherto thought successful won't actually become viable or profitable. This has a ripple effect throughout the economy and prices, instead of heading higher start to head down. This is called deleveraging or price deflation.

Does the money circulation in the economy actually go away? This question has been a point of much debate and confusion within the alternative press. In fact, through workouts and bankruptcies, money (electronic and otherwise) may return to banks where it is then warehoused, not circulated, which would mean, essentially, that the supply of circulating money stock in the larger economy has been reduced. In a sense, this can be considered true deflation (as opposed to price deflation).

This contraction is mimicked as well among consumers who may choose not to circulate paper money and electronic money but to hoard it. During a Great Recession such as the one that the West faces now, money does not circulate freely even though there is a great deal of money within the economy. Bear in mind that it is not only central banks that create money. Credit card companies create money as do private and public business startups, IPOs, etc. But ultimately the initial money come from the central bank and is injected into the economy through its commercial banking disseminators.

The final reason that money does not circulate is because banks do not want to lend. Usually at such times banks are under a lot of pressure to build up their balance sheets, which they do by keeping money rather than lending it and by calling in speculative loans. Also, in the modern era of bailouts, governments tend to prop up failing companies so banks cannot even tell a healthy company from a sick one that will sooner or later go out of business. This also retards the process of money circulation.

Once money has ceased to circulate freely because of the above reasons, the economy itself begins to wind down. Central banks can print more money and urge banks to lend, but in a bad recession or in a depression it is very difficult to start money flowing again until the economy has in a sense cleansed itself and is ready to begin to grow once more.

This is where the larger Western economy is right now, in fact - in a place where money is NOT circulating freely. Central banks have cut interest rates to zero and have begun programs of quantitative easing, which means that central banks are buying (debt) instruments in the open market in the hopes of stimulating growth by adding circulating money to the money supply.

So why isn't it working? Because central banks (the Federal Reserve in particular) are focused only injecting money via large financial institutions and banks. This is a control mechanism. If central banks were to send money to individual entrepreneurs, then citizens would begin to see how farcical the system really is.

In fact, as we have pointed out many times before, the system itself is set up to mimic a real monetary system but it is no such thing. A real monetary system using gold and silver needed bank/warehouses for purposes of money metals storage. But today, banks are merely distribution points and ways to ensure that the flow of money is controlled by the proper gatekeepers. This is why, in fact, deflation is such a problem in a fiat money economy. In a real economy, deflation is a good thing, but in a fiat economy, deflation, at least to some extent, adds insult to injury.

The article which we have excerpted has a telling quote toward the bottom, as follows: "Gabriel Stein, from Lombard Street Research, said the US is still stuck in a quagmire because Mr Bernanke has mismanaged the quantitative easing policy, purchasing the bonds from banks rather than from the non-bank private sector." This is our point exactly. Bernanke will do ANYTHING but distribute money directly to the private sector where it would actually be put immediately to good use and would CIRCULATE.

Thus we see that central banking is not just about trying to control the economy; it is also about giving people a sense that the economy RUNS through banking entities. It is an actionable element of the dominant social theme we referred to at the beginning of this article. Only the smartest of people get to touch the new money, and they must distribute it judiciously. As much as Bernanke, et. al. would like to stimulate the economy, they will not do so by putting money directly into circulation. They will only use channels of authority and control.

The current Western fiat money system is an obscene, impoverishing disgrace. But what is even worse is that central banking authorities would rather let the world slide into an even more terrible financial crisis than to bypass banking and financial channels. Sooner or later there will be inflation, perhaps hyperinflation. There is simply too much money sloshing around in the system. But in the meantime, there will be more debt, less money and ... continued deleveraging.

Conclusion:

Central bankers are actually a quite dramatic breed. They don't seem to be play-acting, but they are. And they will surely continue to cry out loud - to wail and moan - about the dangers of fiat-money deflation. At the same time, they will never, ever let average people get their hands on freshly printed money that could alleviate some of the damage they has been wrought by this horrid system. And thus ... a second "recessionary" wave. That's indeed what may happen next. And Bernanke will continue to whine.

The Banks Keep Stealing - Why Should You Keep Paying?

Dylan Ratigan

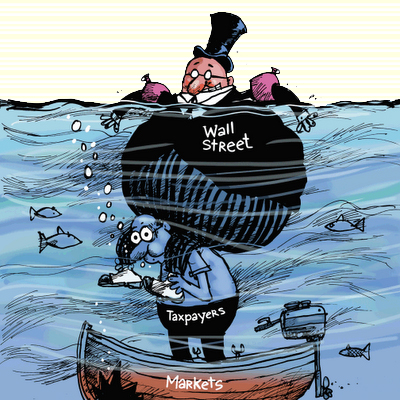

The dire straits of the middle class of America has made it near impossible for our politicians to keep up the pretense that our current government truly works for the "people." Between the multiple overt and secretive bailouts, the massive bonuses and the circular use of our tax money to lobby for these continued handouts, you can no longer hide from the evidence.

When Senator Durbin said "The banks... frankly own this place," you realize it was not in jest.

Couple this with recent protections handed by the Supreme Court to corporations to directly influence elections and it can make things seem hopeless for those not on Wall Street or their chosen politicians. Favored CEOs and now even foreign countries get all the printed money they need, leaving us paying both our bills and theirs.

And now nearly a quarter of all Americans are currently underwater in their mortgage because of that steadfast honor.

If you are one of them, chances are you didn't do anything wrong. Almost all of you were not subprime borrowers or speculators, but merely people buying a house that they thought they could afford at the time. You were just unlucky in that you bought a house during a time when an outdated Wall Street and their complicit politicians decided to use housing to regain the income they lost due to the Schwabs and Etrades of the internet age.

You didn't cause this mess. They did.

Now you are struggling to make the same payments on this mortgage on your now overpriced home even in light of a crashing economy and massive deflation, all while the government does everything in its power to help Wall St. keep the bonuses coming.

The dire straits of the middle class of America has made it near impossible for our politicians to keep up the pretense that our current government truly works for the "people." Between the multiple overt and secretive bailouts, the massive bonuses and the circular use of our tax money to lobby for these continued handouts, you can no longer hide from the evidence.

When Senator Durbin said "The banks... frankly own this place," you realize it was not in jest.

Couple this with recent protections handed by the Supreme Court to corporations to directly influence elections and it can make things seem hopeless for those not on Wall Street or their chosen politicians. Favored CEOs and now even foreign countries get all the printed money they need, leaving us paying both our bills and theirs.

And now nearly a quarter of all Americans are currently underwater in their mortgage because of that steadfast honor.

If you are one of them, chances are you didn't do anything wrong. Almost all of you were not subprime borrowers or speculators, but merely people buying a house that they thought they could afford at the time. You were just unlucky in that you bought a house during a time when an outdated Wall Street and their complicit politicians decided to use housing to regain the income they lost due to the Schwabs and Etrades of the internet age.

You didn't cause this mess. They did.

Now you are struggling to make the same payments on this mortgage on your now overpriced home even in light of a crashing economy and massive deflation, all while the government does everything in its power to help Wall St. keep the bonuses coming.

Well, it is becoming time to take matters into your own hands... I suggest that you call your lender and tell them if they don't lower you mortgage by at least 20%, you are walking away. And if they don't agree, you need to consider walking away. It probably doesn't feel right to you. That is because you probably are a good person. But your mortgage is a business deal, and it is not immoral to walk away from a business deal unless you went in to the deal with the intention of defaulting. But somehow, even though the corporations are pumped to exercise their new rights, former bankers like Henry Paulson, current ones like Jamie Dimon and - get this - now even Fannie Mae execs want to keep you from exercising your rights. But before you let them (or anyone commenting below) force you into paying that $500k mortgage on a $300k house, ask them if they'll push Jerry Speyer into "honoring his obligation" by breaking into his $2 billion personal piggy-bank to keep paying for Stuyvesant Town?

Or how about asking Hank and Jamie to lecture fellow bailed-out CEO John Mack about how "you're supposed to meet your obligations, not run from them"? Maybe make him use some of his $50+ million for those buildings he bought in San Francisco?

And before shaming and punishing American homeowners, did they nag Steve Feinberg about helping "teach the American people...not to run away" by writing a check out of his billion-dollar pocket to cover all the stiffed landlords and vendors at Mervyn's? After all, at least you aren't single-handedly putting 1,100 employees out of work when you walk on your mortgage. As part of the deal for your house, your mortgage holder gets interest payments from you and they also use the note to your house for their capital reserves. In return, they take the risk of a foreclosure. In many states, you paid extra to have a non-recourse loan where the lender just gets the house back if you stop paying - your interest rate would've been much lower if you were held personally liable like a student loan. But if you still feel bad, then donate the money saved to charity instead of to their bonuses. And when someone tries telling you why it is so wrong, here are some answers: - Yes, it might seem selfish, but you are actually going to help fix our country the right way, through the use of pure capitalism. There are 3 parties involved in your mortgage - the mortgage holders, the servicing bank and you. You probably want to stay in your house. Most of the people who actually own your mortgage also want you to stay in your house, preferring a mortgage reduction that you keep paying instead of the total loss of a foreclosure. But the major banks (BofA, Wells Fargo, JP Morgan, Citi, etc.) that underwrite and service the loans don't care about either of you. They (with the aid of their government) just care about hiding their true financial condition for long as possible so they can continue to bonus themselves outrageously. The credible threat of you walking away from your mortgage en masse is the only market-based solution that will force these banks to work with the mortgage holders on your behalf.

- No, you will not "hurt" your neighbors - certainly not near the scale of the banksters. Chances are someone just as nice will you will move in and (unlike you) pay a fair, non-inflated price for the house. Encourage your neighbors to fight back against the banks and ask for their own mortgage reductions as well.

- Yes, it might make getting a loan harder for everyone. Considering the spate 0% down NINJA loans over the past decade, that probably isn't a bad thing.

- Yes, it might hurt your credit. But with time, people bounce back from having foreclosures on their record. Search online and then talk to a lawyer about the repercussions, which vary by state.

- No, the banks won't necessarily pass the losses on to customers. They already make a lot of money. If costs are passed on to every consumer without banks competing on price, that's a sign of illegal collusion or a monopoly. Let's fix that instead of just letting banks ruin our lives. They might, however, not all make $145 billion in bonuses next year doing something fundamentally so easy that it is an unpaid job in Monopoly. Meanwhile, our captured government has made it clear that they want to further reward these banksters because there are clearly better ways to "save" the economy without rewarding those most responsible for the damage. Instead of claw backs for the past theft and strong financial reform for the future, they choose to cover-up the gross misuse of our tax money, making our country worse by helping the criminals on the backs of the most honest. But thankfully, in this country we still have the tools to fight back and regain our country. Our vote, our voice, our laws and what we choose to do with every penny we have that doesn't go to taxes are the benefits of our hard-fought freedom, and in this battle we must use them all to fight back. It's time for the citizens to once again own this place.

Fed Looks to Hyperinflate

The Daily Bell

RBS tells clients to prepare for "monster" money printing by the Federal Reserve ... As recovery starts to stall in the US and Europe with echoes of mid-1931, bond experts are once again dusting off a speech by Ben Bernanke (Left) given eight years ago as a freshman governor at the Federal Reserve. Entitled "Deflation: Making Sure It Doesn't Happen Here", it is a warfare manual for defeating economic slumps by use of extreme monetary stimulus once interest rates have dropped to zero, and implicitly once governments have spent themselves to near bankruptcy. The speech is best known for its irreverent one-liner: "The US government has a technology, called a printing press, that allows it to produce as many US dollars as it wishes at essentially no cost." Bernanke began putting the script into action after the credit system seized up in 2008, purchasing $1.75 trillion of Treasuries, mortgage securities, and agency bonds to shore up the US credit system. He stopped far short of the $5 trillion balance sheet quietly pencilled in by the Fed Board as the upper limit for quantitative easing (QE). Investors basking in Wall Street's V-shaped rally had assumed that this bizarre episode was over. So did the Fed, which has been shutting liquidity spigots one by one. But the latest batch of data is disturbing. – UK Telegraph

Dominant Social Theme:

We'll dump as much money into the market as necessary – until it surrenders and does our bidding.

Free-Market Analysis:

This potential move gives the deflation versus inflation debate a new perspective. We have written in the past that we had questions about the Great Depression based on conflicting opinions of Murray Rothbard, Milton Friedman et. al. Living through the "Great Recession" has begun to clear them up. It is a little like being a lab rat; it is painful, but the experience gives you an insider's look at the scientific method. Or in this case a fiat-money economy.

In previous articles we have examined the inflation versus deflation debate at some length. Now it could be that you, dear reader, are tired of reading about arcane monetary policy matters, but in fact, this is just what the power elite wishes will happen. The monetary economy has been made so complex through the ruse of central banking and a ridiculous vocabulary that unless one confronts the situation with the requisite ruthless cynicism, one is apt to be overwhelmed.

This is a dominant social theme of course, one that goes something like this: "We are the great collective OZ. You may petition us, though surely you will not comprehend our toolkit, understand our terminology or appreciate our strategies. We will explain the progress being made in due course – and you better believe it!" Admittedly this is a cynical reading of the promotion underway but nonetheless we think it is accurate.

Yes, complexity is important in that it obscures failure. There have been numerous grinding recessions since the central banking era began in the early 1900s. Now in the early 2000s, we look back on what has occurred and we ask ourselves, what has improved? The United States is nearly bankrupt and so are the European economies. Wherever mercantilist central banking has been tried, ruination has followed. Every cycle has produced less job growth and further centralized what industry remains, truly creating a managerial state.

Those in charge of the system have invented an entire nomenclature to impress the general public with the complexity of their strategies. Let us then examine the massive, additional "quantitative easing" that Bernanke is contemplating. (Ed Note: you can skip this part if you want and direct your attention to our considerably more succinct version below) ...

Quantitative Easing: Central banks normally set the price of money using official interest rates to regulate the economy. These interest rates radiate out to the rest of the economy. They affect the cost of loans paid by companies, the cost of mortgages for households and the return on saving money. Higher interest rates make borrowing less attractive because taking out a loan becomes more expensive. They also make saving more attractive, demand and spending reduces. Lower interest rates have the reverse effect. But interest rates cannot be cut below zero and when official rates get close to zero the effect they have on regulating the economy becomes muted. Banks still need to make a profit and in troubled times the gap between the official interest rate and the rates faced by companies and households can rise, because lenders want a greater return for the additional risk of granting a loan when times are tough.

When interest rates are close to zero there is another way of affecting the price of money: Quantitative Easing (QE). The aim is still to bring down interest rates faced by companies and households and the most important step in QE is that the central bank creates new money for use in an economy. Only a central bank can do this because its money is accepted as payment by everybody. Sometimes dubbed incorrectly "printing money" a central bank simply creates new money at the stroke of a computer key, in effect increasing the credit in its own bank account.

It can then use this new money to buy whatever assets it likes: government bonds, equities, houses, corporate bonds or other assets from banks. With the central bank weighing in, the price of the assets it buys should rise and the yield, or interest rate, on that asset will fall. Companies for example with a willing central bank seeking to buy its bond, will be able to pay a lower interest rate when new bonds are issued or existing bonds come to the end of their life and need to be replaced.

With cheaper borrowing the hope is that the central bank will again encourage greater spending, putting additional demand into the economy and pulling it out of recession. As the money ends up in bank deposits, banks should also find their funding position improved and make them more willing to lend. A side effect will be that this new money is expected to raise consumer prices giving people another incentive to buy now rather than later. – Financial Times

See how many words it takes? Our definition is a little simpler. It would run something like this: "Quantitative easing is when central banks create new electronic money out of thin air and spend it buying up mostly financial assets in the hopes that such spending will kick-start consumer purchases and end the recession." We would change the name of the procedure, too. We would call it "Making Money From Nothing and Buying Things With It." There is probably a reason why central banks don't go along with this kind of nomenclature, as it more fully reveals the ludicrousness of what's going on and does so with a minimal amount of syllables.

Of course the question really comes down to what central banks are doing with the additional money that they are creating from nothing. (It should also be noted that central banks are ALWAYS creating money out of thin air and the difference is simply that when banks are involved with "quantitative easing," they are injecting money directly into the economy, not running it through commercial banks or designated bond dealers.) In this case, central banks are going out into the market place and buying whatever they want to, stocks, bonds, IPOs, mortgages, anything that the bankers believe will inject money into the "real" economy to get the money circulating again.

This brings us back to the articles we have written previously. We pointed out only a few days ago as a matter of fact that the reason previous stimuli had worked so poorly was because the Federal Reserve was determined to go through the banking system itself or various fiduciaries rather than put the money into the hands of people who would really spend it. The reason to go through the banking system was to preserve the fiction that banks were the necessary final adjudicators of who gets what money. The idea is that you wouldn't just hand out drugs to people – you'd prescribe them through a doctor. Thus, too, money is not to be handed out either but must travel through appropriate, professional channels.

It is all, actually, simply a matter of control. And in fact the money that the Federal Reserve and other central banks will provide via this next bout of quantitative easing, if it comes to that, will not end up in the hands of people either. Here's betting it will STILL go to financial entities, though maybe not directly to banks anymore. And for this reason, among others, it STILL may not have the desired effect, certainly not right away. As we have written before, central banks will do almost anything rather than send money to individuals, entrepreneurs and small companies because to do so invalidates the fiction that the painstakingly created and cultivated banking network is necessary – it is not.

We have spent so much time of late on deflation and inflation because we are getting to the point in the business cycle when such musings become important from a real-life standpoint. Unlike central bankers, we don't fight our intuition when it comes to the business cycle. (Intuition being part of the Austrian economic approach.) We were, for instance, well aware at the beginning of the decade that gold was going to travel to US$1,000 or more based on what we understood of the upcoming money-metals bull market. Just as we were aware that the fiat-money bear market is going to run at least 15 years, which means there are about five years to go.

We base this on our understanding of current marketplace distortion. In the 1970s it took about 10-12 years to unwind the economy and cleanse it to a point where much of the distortion had subsided. But this time, THIS Western economy is a heckuva lot more screwed up. So it will take longer. And that's why we knew that all the recent talk by so many respected mainstream Western economists and politicos about a recovery was likely so much hooey. We figured there were several more shoes to drop. And they've begun to drop – or Bernanke wouldn't be looking at another US$5 trillion in "stimulus." Recovery indeed.

What's going on? Because the Western economy is still in such sad shape, still distorted – more than ever as a matter of fact because so many ruined entities have been designated as too-big-to-fail – money is still refusing to circulate and economies themselves are still spiraling downhill, refusing to create new jobs, etc. We have shown in previous articles how the power elite is using this price-deflation to set up "austerity" in Europe and America and to privatize and purchase assets at a cut-rate price.

We have also indicated, via an article on George Soros, that the elite is panic-stricken that deflation may go too far, too fast and cause widespread unrest and rioting. In fact, we think this is exactly what is going to happen. But for those who believed we were incorrect about the elite's panic in the face of a deflationary overshoot, we seem to have a definitive answer – US$5 trillion in ADDITIONAL quantitative easing. That number has flop-sweat written all over it.

We will not by the way in this article get into another discussion about whether inflation or deflation is "good." We are on record numerous times as stating that mild deflation (real deflation – a contraction of the money supply and credit) is indeed good during a downturn in a real-money (gold and silver) economy. But in a fiat money system such as the one we have now, everything is turned upside down.

It is like a Mad Hatter's tea-party and even the words themselves have lost meaning. In a fiat money environment, for instance, one can likely have a collapse of credit and subsequent price deflation without necessarily a real contraction of the money stock. Central bankers love such complexity. Being of modest intellect (versus the Masters of the Universe), we don't, however, and likely neither do you. We try to simplify relentlessly, that being the best defense against professional complicators. And in a number of articles on inflation and deflation we have applied this technique as tenaciously as possible.

Thus we are on fairly comfortable ground predicting again, as we have before, that given the slowing velocity of money, price-deflation, especially, will continue. It will continue and continue until such time as the larger Western economy is sufficiently unwound so as to begin to utilize the oceans of cash that are sloshing around within the walls of its most august institutions and under mattresses in the houses of long-suffering citizens. At this point, price inflation will arrive with a ferocity that may eventually lead to hyperinflation.

We hope we have not bored you, dear reader. Above is yet another effort at keeping up with what the banking class has in mind for us. It IS important, because the kinds of money movements that we are analyzing constitute massively powerful trends. If and when price inflation kicks in (we think it will, as it always does in these business cycles) the results will likely have a life of their own and be no more controllable than price deflation is currently.

Yes, this is important to realize. It is why we think the system may ultimately collapse. (In fact it has collapsed but remains functioning because of central banking life support.) It is why we think gold and silver will continue to travel up and are probably not in a "bubble" but represent the true valuation of current Western fiat currencies which are currently spiraling down toward zero.

Conclusion:

It is, in fact, not all that complicated, even though central bankers try to make it seem so. The ultimate effects of US$5 trillion of additional money on the economy are also predictable. We must draw two conclusions if such a sizeable injection occurs. First, the elite is in fact panicked about societal unrest as a result of this gargantuan bust – the "Great Recession." Second, they are willing to risk hyperinflation later to steady Western economies now. Keep analyzing those memes.

The Art of Speculation

Howard S. Katz

After the great gold bug victory of the 1970s, the economic establishment had been humiliated and disgraced. This was because none of them knew any economics. They all had gotten their fancy titles and positions by apologizing for the bankers' privilege to create money. The bankers (and their associated vested interests) got rich. The American people got poor. (This is the first generation of Americans poorer than their parents.) And so it paid off for the bankers to hire a gang of charlatans, buy them fancy titles and infiltrate them into prestigious positions in academia so that they could use their prestige to defend the bankers' privilege to create money.

After the great gold bug victory of the 1970s, the economic establishment had been humiliated and disgraced. This was because none of them knew any economics. They all had gotten their fancy titles and positions by apologizing for the bankers' privilege to create money. The bankers (and their associated vested interests) got rich. The American people got poor. (This is the first generation of Americans poorer than their parents.) And so it paid off for the bankers to hire a gang of charlatans, buy them fancy titles and infiltrate them into prestigious positions in academia so that they could use their prestige to defend the bankers' privilege to create money.

The gold bugs of the late 1960s wiped the floor with these phonies. We saw clearly that the price of gold, then $35, was going up and advised people to buy gold stocks. The establishment, scared to death that any mention of gold would lead to demands for a gold standard (which would take away the bankers' privilege), responded, not with their (pitifully weak) theories but with insults and ad hominem attacks.

In other words, the economists you see quoted in almost every newspaper are shills and hacks. A more disgusting and contemptible group of weasels does not exist on this earth. (Don't worry that I am going to get into trouble by speaking so frankly. You see, the establishment deals with me via the same technique they use on the price of gold. They pretend that I do not exist.

So I decided at the beginning of the 3rd millennium A.D. to seek a little justice. I am challenging all of the nation's mutual funds to a race – the race of the millennium – in which I compare my performance (printed fortnightly in the One-handed Economist) with Lipper's Diversified Equity Funds, published quarterly and carried in Barron's.

As you can see, it is a rout. For the first half of the decade, I was bullish on stocks. I turned bullish on gold in December 2002 but was of the opinion that the housing stocks would outperform gold for a while. During 2005 I shifted completely into gold and have been a gold bug ever since.

For most of the first 3 years of the decade, I was bearish on stocks, but I turned bullish on Oct. 11, 2002, just one day after the bear market bottom. I thus avoided losing money in the 2000-2002 bear market, and I made nice profits in the early years of the 2003-2007 bull.

I failed to predict the late 2008 bear, but I was in gold stocks, and they bounced back rapidly. I stuck to my position, and the subscriber who began following me on Jan. 1, 2000 today has almost doubled his capital. Compare this with the average establishment broker, advisor or what-have-you, whose clients have not quite broken even over the period.

There is a financial radio show in my section of the country which bills itself as the best money show on radio. It recommends only mutual funds; so you know that its performance over the decade is very close to that described in the chart above – that is zero. One week a caller asked the show's opinion about gold. The host hit the roof. Gold is a collectable. Gold does not pay interest.

That is true, but computing from its 2008 high gold is up 25%. The DJI is down 25%. The S&P is down 28%. Computing from Jan. 1, 2000 gold is up 336%. The DJI is down 13%. The S&P is down, again, 28%. Compared to that interest is a pittance.

Let us look more closely at the accusation collectable. Is this for real? Why should a person not buy a collectable? Is money made on a collectable inferior to other money? Don't collectables go up in price? Have you ever heard of collectors' art, rare stamps and coins?

Of course, when this gentleman said “collectable,” he really meant speculation. His point was not that collectables go down in price. (They mostly go up.) It was that, if you speculate, then you are a bad person. The argument is: don't make money because then you will be a bad person. If this is the case, then the listeners to this (and many other) radio show(s) are definitely good people because they are not making any money. Actually, speculation is a valuable skill to society because it brings prices of goods closer to their true value. The good speculator buys goods when they are relatively low and sells them when they are relatively high. He exerts a bullish force when the price is low and a bearish force when it is high. He thus moderates price fluctuations. So when the investor steps in to let his capital be used by American industry, he pays a price approximating true value, and the same is true when he sells. Thus the investor says, “Thank you speculator for maintaining a price which is reasonable and accurate. You are an asset to the economy.”

After the 1929 crash, the Democrats accused bearish speculators of selling short and increasing the severity of the crash. At that time, no statistics were kept on selling short, but as a result of the fuss raised by the Democrats, the SEC started gathering statistics. These statistics have shown that in every bear market since that time the shorts covered their positions as the market fell (thus moderating the decline). In every bull market, the shorts put out their lines as the market rose (thus moderating the advance). In this way, shorts have been a moderating force on the market since records have been kept.

What did cause the 1929 crash was government in the form of Herbert Hoover. Hoover's beliefs were back in the Middle Ages; he thought that both speculation and lending at interest were wrong. Hating both of these Hoover banned lending money at interest for the purpose of speculation (brokers' loan rate). The bullish speculators were forced to sell (because they could not get loans to carry their positions), and the crash of Sept.-Oct. 1929 was the result. The crash was then blamed on economic freedom and used to justify many of the measures of the New Deal. (I know, you were told that Herbert Hoover was the last defender of free enterprise. That was a blatant and outrageous lie. Indeed, in the early 1920s, FDR recommended Hoover for President, saying, “There could not be a better one.”)

The issue of investment versus speculation is much more important than you realize. Almost everyone, except for me, will tell you that you are an investor. But an investor is someone who wants to put his money to work (meaning either earning real interest or a return on capital such as dividends on stocks or rent on real estate). The speculator wants to make a profit by buying low and selling high. As noted, both have a legitimate place in a free economy. But you are being misled by advisors who, believing speculation to be evil, avoid stepping on your ego by calling you an investor. I remember that at the gold conferences of the 1970s people were lulled to sleep by being told that they were investors.

You see, speculation can be very profitable, but it is also difficult. When you speculate, you are in the big leagues playing against the best players. You are trying to take their money, and they are trying to take your money. Good speculation demands the best thinking that you have. The investor, on the other hand, does not have to think too hard. He relies upon the speculator to set the price somewhere near true value, and that is good enough for him. All he is interested in is his coupon/dividend, etc.

So by calling you an investor, they are lulling you to sleep. They are hiding the fact that you need to put in good, hard study to win at this game. For example, from time to time I will recommend Technical Analysis of Stock Trends by Edwards and Magee. Also highly recommended are the works of Ludwig von Mises and Murray Rothbard. But these require hard work, and if you are not up to it, then do not try to make a career of speculation. Speculation differs from all other professions in that, when you mess up, you pay them. It is sort of a negative salary. After all, Warren Buffet did not get rich by letting people like you take his money.

One thing which the astute speculator must quickly learn is that human beings have a deep urge to follow the crowd. Such people all want to have the same opinion as their fellows. For this reason, they are prone to enormous swings in opinion. Most people get their opinions from their local papers. But the local papers, also feeling the same urge, want to have the same opinion as the New York Times. Thus the entire nation is swept by the same opinion.

It would be one thing if the institution which everyone was following had established a record for accuracy. But exactly the opposite is the case. The last two big examples are the 1982 bottom, when the Times was trumpeting Henry Kaufman, who was predicting depression, and the 2000 top, when the Times was trumpeting Glassman and Hassett (Dow 36,000) In 1982, the New York Times stock was 3. In 2000, the stock was 40. And in March 2009 it was back just a little above 3 again. Everyone who followed the Times lost their shirts, and many of them do not know that the Times exists. The Times itself had a financial crisis. They had to mortgage their new headquarters and take a loan from Mexican billionaire Carlos Slim. They slapped down the Boston Globe unions in a manner that can only be described as union busting and which, if done by anyone else, would have provoked a scathing editorial in the Times.

Actually, the Times became a great paper because of Adolph Ochs, who took it over in 1896. That was the year of the great political battle over the gold standard in which McKinley (pro-gold) defeated Bryan (anti-gold), and that was the year that the phrase “gold bug” was first used as a label for a supporter of the gold standard. Ochs was a gold bug in this original sense. He was also a believer in free enterprise, an enemy of socialism and a true American. His family, who turned his paper into a socialist rag, have betrayed him, the paper he left them and their country. But reputations sometimes persist for a long time after they have ceased to be deserved, and that is the case with today's Times.

If you want to be a successful speculator, you must make a commitment to see reality as it is, not reality as seen by other people, not reality as you want it to be. If you develop a theory about the market, you must test that theory against the facts. If it doesn't work, then it isn't true. (By their fruits ye shall know them.)

A study of the markets show that the short term is hard to trade, and on this level most people lose. The path to success is to play the big moves. The big money is made in the big moves. The big moves are easy to trade. You get on board the trend. You do not try to catch the exact top or bottom. You just ride the trend and let it make money for you. Look at some of the big trends of our era: silver 1971-1980, up 38 times, gold 1970-1980, up 25 times, DJI 1982-2007, up 18 times, S&P 1982-2007, up 15½ times. In every one of these, as the trend was just beginning to lift off, the vast majority of people decided that the market was much too high and chickened out. I have mentioned the gold bug who, in 1972, with gold at $65/oz., gave up his hope that it would ever hit $70. There was Robert Prechter, who forecast DJI 3,600 in the early 1980s, gave up too soon and remained stubbornly bearish from 1987 to today. If you don't need the psychological comfort of having others agree with you, then you have the mental toughness to make it as a speculator. You are one of the few, good men for whom the One-handed Economist is looking.

Howard S. Katz holds a BA in mathematics from Harvard University. He became interested in Austrian economics and started a successful investment newsletter, The Speculator which focused on gold and gold stocks. He is a lifelong advocate of gold and gold stock investing. Later, he published The Gunslinger for investors interested in gold and gold stocks. In addition, Mr. Katz authored three books on gold, the gold standard and money in politics: "The Paper Aristocracy", "The Warmongers" and the soon to be published "Wolf in Sheep's Clothing". He was involved in the Objectivist movement in New York in the 1960s and was an early member of New York's Free Libertarian Party. Mr. Katz is a contributing author to The Ludwig von Mises Institute where his writings appear along with those of contemporaries Llewellyn H. Rockwell, Jr., Murry Rothbard and Robert Murphy, among others. He has been interviewed on numerous radio programs. He is currently Chief Investment Officer, editor and publisher of the gold and gold stock investment newsletter, The One-handed Economist.

Howard S. Katz holds a BA in mathematics from Harvard University. He became interested in Austrian economics and started a successful investment newsletter, The Speculator which focused on gold and gold stocks. He is a lifelong advocate of gold and gold stock investing. Later, he published The Gunslinger for investors interested in gold and gold stocks. In addition, Mr. Katz authored three books on gold, the gold standard and money in politics: "The Paper Aristocracy", "The Warmongers" and the soon to be published "Wolf in Sheep's Clothing". He was involved in the Objectivist movement in New York in the 1960s and was an early member of New York's Free Libertarian Party. Mr. Katz is a contributing author to The Ludwig von Mises Institute where his writings appear along with those of contemporaries Llewellyn H. Rockwell, Jr., Murry Rothbard and Robert Murphy, among others. He has been interviewed on numerous radio programs. He is currently Chief Investment Officer, editor and publisher of the gold and gold stock investment newsletter, The One-handed Economist.

A bankrupt BP is worse for the financial world than Lehman

Filed under: Jim's Mailbox

Dear CIGAs,

A bankrupt BP is worse for the financial world than Lehman Brothers was for exactly the same reason.

Pedro’s credentials in energy exceed by orders of magnitude those talking heads giving daily BP opinions. In fact, Pedro’s credentials might just be better than all of them added together.

Please read this article closely, and share it with others. It is just that important.

Regards, Jim

Dear Jim,

The BP crisis in the Gulf of Mexico has rightfully been analysed from the ecological perspective. People’s lives and livelihoods are in grave danger. But that focus has equally masked something very serious from a financial perspective, in my opinion, that could lead to an acceleration of the crisis brought about by the Lehman implosion.

People are seriously underestimating how much liquidity in the global financial world is dependent on a solvent BP. BP extends credit – through trading and finance. They extend the amounts, quality and duration of credit a bank could only dream of. The Gold community should think about the financial muscle behind a company with 100+ years of proven oil and gas reserves. Think about that in comparison with what a bank, with few tangible assets, (truly, not allegedly) possesses (no wonder they all started trading for a living!). Then think about what happens if BP goes under. This is no bank. With proven reserves and wells in the ground, equity in fields all over the planet, in terms of credit quality and credit provision – nothing can match an oil major. God only knows how many assets around the planet are dependent on credit and finance extended from BP. It is likely to dwarf any banking entity in multiples.

And at the heart of it all are those dreadful OTC derivatives again! Banks try and lean on major oil companies because they have exactly the kind of credit-worthiness that they themselves lack. In fact, major oil companies, conversely, spend large amounts of time both denying Banks credit and trying to get Bank risk off of their books in their trading operations. Oil companies have always mistrusted bank creditworthiness and have largely considered the banking industry a bad financial joke. Banks plead with oil companies to let them trade beyond one year in duration. Banks even used to do losing trades with oil companies simply to get them on their trading register… a foot in the door so that they could subsequently beg for an extension in credit size and duration. For the banks, all trading was based on what the early derivatives giant, Bankers Trust, named their trading system: RAROC – or, Risk Adjusted Return on Credit. Trading is a function of credit bequeathed, mixed with the risk of the (trading) position. As trading and credit are intertwined, we might do well to remember what might happen to global liquidity and markets if BP suffers what many believe to be its deserved fate of bankruptcy. The Intercontinental Exchange (ICE) has already been and will be further undermined by BP’s distress. They are one of the only “hard asset” entities backing up this so-called exchange.

If BP does go bust (regardless of whether it is deserved), and even if it is just badly wounded and the US entity is allowed to fail, the long-term OTC derivatives in the oil, refined products and natural gas markets that get nullified could be catastrophic. These will kick-back into the banking system. BP is the primary player on the long-end of the energy curve. How exposed are Goldman sub J. Aron, Morgan Stanley and JPM? Probably hugely. Now credit has been cut to BP. Counter-parties will not accept their name beyond one year in duration. This is unheard of. A giant is on the ropes. If he falls, the very earth may shake as he hits the ground.

As we are beginning to see, the Western pension structure, financial trading and global credit are all inter-twined. BP is central to this, as a massive supplier of what many believe(d) to be AAA credit. So while we see banks roll over and die, and sovereign entities begin to falter… we now have a major oil company on the verge of going under. Another leg of the global economic “chair” is being viciously kicked out from under us. Ecological damage is not just an eco-event on its isolated own. It has been added to the list of man-made disasters jeopardizing the world economy. The price tag and resultant knock-on effects of a BP failure could easily be equal to that of a Lehman, if not more. It is surely, at the very least, Enron x10.

All the counter-party risk associated with the current BP situation means the term curve of the global oil trade has likely shut down. Here we have yet another credit-based event causing a lock-up in markets that will now impede trade and commerce. It looks like an exact replication of the 2008 credit market seizure could ensue all over again – and it could probably be a lot worse. The world is in a far more delicate state now.

Although never really discussed, the world is highly reliant on BPs provision of long-term credit to many core industries. Who makes good on all the outstanding paper that so many smaller oil, gas and electricity companies, airlines, shipping companies, local bus, railway and transportation networks that rely on BPs creditworthiness and performance for? It doesn’t take a genius to figure out how this could all unwind. If BP has to be bailed-out, like a bank, the system will have to print even more unimaginable amounts of money.

The market, intellectually lazy and slow to realization, as it often is, probably has not woken up to it yet – but the BP crisis could unleash damage similar to the banking crisis. A BP failure through bankruptcy could make Lehman look small in comparison, and shake the financial house of cards we live in even more severely. If the implicit danger of the possibilities imbedded in such an event doesn’t make an individual now turn towards Gold at full speed, it is likely that nothing will.

Respectfully yours, CIGA Pedro

Jim Sinclair’s Commentary

No surprise where the Cando is concerned for you.

Canada’s economy is suddenly the envy of the world CIGA Eric

Canada Inc will be reflected in the exchange rate of the Canadian Dollar (Loonie). Par or better with the U.S. dollar is coming.

The 20 world leaders at an economic summit in Toronto next weekend will find themselves in a country that has avoided a banking crisis where others have floundered, and whose economy grew at a 6.1 percent annual rate in the first three months of this year. The housing market is hot and three-quarters of the 400,000 jobs lost during the recession have been recovered.

Source: news.yahoo.com

The Slow Decay of a Healthy Economy

Bill Bonner

Today, we boldly announce a NEW THEORY about the way the world works.

Today, we boldly announce a NEW THEORY about the way the world works.

Yes, dear reader, you are the first to hear it.

But before we get to that, let's talk about what's going on in the markets.

Stocks continued shuffling along like zombies...the Dow rose 24 points. But gold shot up to $1,248 - a new record.

Makes you wonder. Inflation is no threat to anyone...at least, not now. The economy is recovering - at least, that's what everyone says. So why is gold hitting a record high? Something must be wrong.

Something is wrong.

Gold buyers are probably just like us. They're not sure exactly what is wrong. But they know something is rotten in the state of Denmark. And Greece. And Spain. And New York. And California. In Washington, DC. And in the Gulf of Mexico.

We just had the biggest financial crack-up of all time. Even under ideal conditions, it will take people a long time to rebuild lost savings...to get rid of houses they can't afford...and to restructure debt they can't pay. While this restructuring and adjustment is going on, you'd expect the markets to be a little punky.

But instead of letting people get on with it, the zombies have moved in. At first, you hardly notice. An arm here. A leg there. Pretty soon, you're dead!

The percentage of the economy controlled, guaranteed, or paid for by the government is increasing. Since the feds were already deeply in debt themselves, the only way they could spend more money was by borrowing more. You can't cure a debt problem by borrowing more money. Net debt is going up. So, there's something wrong. The economy isn't recovering... It's just not possible.

Which brings us back to our new theory...

Many are the ideas about how the world rumbles and trundles along. Most have some sort of dialectic at the center of them...some tension between one thing and another that causes them to oscillate to and fro...some yin and yang of opposing forces, constantly battling it out for control.

Good vs. Evil. Progress vs. Backsliding. The proletariat against the bourgeoisie. The moneyed elite vs. the people. Democracy vs. Totalitarianism. Freedom vs. Slavery.

Here we offer a new and improved theory with a dynamic of its own: the producers vs. the parasites.

Yesterday, we read in the local Washington newspaper that the parasites gained more ground in suburban Maryland. It was a minor issue on a minor page of a minor section of the paper. But that's the way the parasites work. Little by little...an arm here...a leg there.

In the present instance, people who live in trailer parks can now feed on the people who own the ground beneath their feet. The state government has added a term to their contracts that neither party agreed to. Henceforth, if the trailer park owner wishes to close down his business, he cannot merely honor the terms of his contract with his lessees. He must also pay them off according to a formula decreed by the legislature. Trailer park residents have been zombified.

A bigger illustration can be found on the front page of yesterday's paper.

BP has agreed to provide the zombies with $20 billion dollars of raw meat:

"BP backs $20 billion spill fund," says The Financial Times.

BP is a producer. It makes something valuable. In fact, it makes the thing that is the pentagon's most valuable and most important resource - liquid energy. It does so at a profit, also rewarding all the little old ladies, lonely orphans and rich sons-of-a-gun who own its shares. BP normally pays dividends; those dividends are currently suspended, as BP diverts cash to the spill fund.

Yes, it also makes mistakes, for which it must pay.

But circling BP today is an army of parasites. Zombies who toil not. Neither do they spin. Instead, they file lawsuits and try to get something from the producers without paying for it. BP's Gulf disaster is a godsend for them. Like a busload of plump English tourists delivered to a bad neighborhood...

The Democrats have always been the recipients of big donations from tort lawyers. Many lawmakers of both parties are lawyers, which is to say they were probably parasites even before they entered public service. It is not surprising that their instincts are the same - to leech onto productive businesses.

Remember the giant tobacco settlement? In 1998, the tobacco companies lay down and opened their veins. A quarter of a trillion dollars was paid out in a huge class action settlement. The money was supposed to go to redress the damage done by smoking. But $19 out of every $20 found its way, instead, into the pockets of the lawyers, the activists, and the bureaucrats. That is to say - the zombies got it.

Will the oil settlement be any different? Not likely. The zombies will take most of it. Much of the rest will be used to turn honest working people into zombies. Instead of finding new work in new areas, for example, Gulf-area residents will be encouraged to stay put and collect checks. If they take up new work, the measure of their 'damages' will go down!

Here is our theory: in the beginning, an economy, a business, a nation...or even a family budget...is fresh, clean and dynamic. Over time, little by little, the parasites encrust themselves -like barnacles on a ship. Then, they grow. Eventually, they become as fat as ticks on a hound in the summertime...

At first, they are just nuisances. The economy can support them.

'The masses want bread? Sure why not. Give them a circus too. And give my lazy brother-in-law a sinecure.'

Gradually, more and more people get their teeth into it. An unnecessary department in a thriving business. A subsidy to one group. A special favor to another. A make-work job...a handout...a bailout... An expense here. An extravagance there...

When things go well, the parasites take more blood. Heck, the economy can afford it. When they go badly, they grab the weakened host and pull it down in a feeding frenzy. BP, are you ready?

They succeed because in most cases it is generally cheaper to go along than to fight.

Without hardly noticing, the living become cooperative zombies too. The cigarette companies become tax collectors for the feds. The oil companies too. Doctors go along with nationalized health care. Teachers get their lifetime tenure. Ordinary citizens stand in line to be inspected at airports, counted by census takers, interrogated by tax collectors. Soon, the whole nation is zombified.

The zombies win. And then...there is collapse, war, revolution, bankruptcy... The zombies are killed off...new life begins.

That's why the feds fight so hard to prevent a financial collapse. The last thing they want is a fresh, new, healthy economy...

Bill Bonner

Since founding Agora Inc. in 1979, Bill Bonner has found success and garnered camaraderie in numerous communities and industries. A man of many talents, his entrepreneurial savvy, unique writings, philanthropic undertakings, and preservationist activities have all been recognized and awarded by some of America's most respected authorities. Along with Addison Wiggin, his friend and colleague, Bill has written two New York Times best-selling books, Financial Reckoning Day and Empire of Debt. Both works have been critically acclaimed internationally. With political journalist Lila Rajiva, he wrote his third New York Times best-selling book, Mobs, Messiahs and Markets, which offers concrete advice on how to avoid the public spectacle of modern finance. Since 1999, Bill has been a daily contributor and the driving force behind The Daily Reckoning.

Central Banks Buy Gold - $1300 Gold Next Week?

Lear Capital

As is typical of me, I saw gold making a significant move today so I tuned in to the Financial News channels to see what all the geniuses were saying about gold.

One commentator suggested gold was more than a safe haven now, it's a currency play, as the world's currencies all seem to be teetering on the brink of debasement. Another said the technicals on Gold suggest it will hit $1300 as early as next week. And still another reporter chimed in and said but today's volume is low so be careful. Higher prices on lower volume can be dangerous to buy into.

Then as if the floodgates of gold news have opened, I also read two articles on gold. One says Central Banks are now buying Gold and another states that gold still has a long way to rise.

Ho Hum! This is all old news to our loyal readers but you know I have to comment. As far as gold being a currency play, of course as world currencies falter, investors move out of currencies and into something they deem safe. Of late, investors have been escaping the Euro and into gold, U.S. Treasuries and maybe even the dollar as now the dollar is seen as one of the world's least weak of many other currencies.

To the comment that we could see gold at $1300 as early as next week, we at Lear Capital have been saying for months, that we are in the gold-at-$1500-by-the-end-of-the-year camp. Being it is half way through the year, it's about the right time to hit $1300, considering gold's propensity for a steady climb.

Here's my favorite one. "Gold is trading on low volume today so be careful." (I paraphrased a little) Low volume is often attributed to lack of buyers. But given gold supply has notably run out a couple times in the last year or so, I say low volume can just as easily be attributed to lack of sellers. Do you want to sell your gold today?

I submit, people who own gold today do not own it so they can make a few points of return. They own gold it because they are uncertain about the future of the world's economies. Make no mistake, gold demand is on the rise.

The article today that finally acknowledges Central Bank demand, is indicative of my point. I think the article is a little after-the-fact, myself, as much of what is talked about in the article occurred months ago. Ok, so a couple new buyers were added to the list, I hardly think purchases by Kazakhstan and the Phillipines is more newsworthy than China, India and Russia all adding to their reserves months ago.

The bottom line is there are many reasons to own gold in today's world of uncertainty. Yes, gold is still a safe haven in times of market volatility. Yes, gold is still an inflation hedge. Yes, people buy gold coins because deficits are at record levels and debt is reaching the point of no return.

Other than that there are no real good reasons to own gold.

As is typical of me, I saw gold making a significant move today so I tuned in to the Financial News channels to see what all the geniuses were saying about gold.

One commentator suggested gold was more than a safe haven now, it's a currency play, as the world's currencies all seem to be teetering on the brink of debasement. Another said the technicals on Gold suggest it will hit $1300 as early as next week. And still another reporter chimed in and said but today's volume is low so be careful. Higher prices on lower volume can be dangerous to buy into.

Then as if the floodgates of gold news have opened, I also read two articles on gold. One says Central Banks are now buying Gold and another states that gold still has a long way to rise.

Ho Hum! This is all old news to our loyal readers but you know I have to comment. As far as gold being a currency play, of course as world currencies falter, investors move out of currencies and into something they deem safe. Of late, investors have been escaping the Euro and into gold, U.S. Treasuries and maybe even the dollar as now the dollar is seen as one of the world's least weak of many other currencies.

To the comment that we could see gold at $1300 as early as next week, we at Lear Capital have been saying for months, that we are in the gold-at-$1500-by-the-end-of-the-year camp. Being it is half way through the year, it's about the right time to hit $1300, considering gold's propensity for a steady climb.

Here's my favorite one. "Gold is trading on low volume today so be careful." (I paraphrased a little) Low volume is often attributed to lack of buyers. But given gold supply has notably run out a couple times in the last year or so, I say low volume can just as easily be attributed to lack of sellers. Do you want to sell your gold today?

I submit, people who own gold today do not own it so they can make a few points of return. They own gold it because they are uncertain about the future of the world's economies. Make no mistake, gold demand is on the rise.

The article today that finally acknowledges Central Bank demand, is indicative of my point. I think the article is a little after-the-fact, myself, as much of what is talked about in the article occurred months ago. Ok, so a couple new buyers were added to the list, I hardly think purchases by Kazakhstan and the Phillipines is more newsworthy than China, India and Russia all adding to their reserves months ago.

The bottom line is there are many reasons to own gold in today's world of uncertainty. Yes, gold is still a safe haven in times of market volatility. Yes, gold is still an inflation hedge. Yes, people buy gold coins because deficits are at record levels and debt is reaching the point of no return.

Other than that there are no real good reasons to own gold.

US Dollar: The Mother of All Bubbles

Jesse's Café Américain

A bubble is a significant increase in valuation supported by a set of artificial, inexplicable, and otherwise unsustainable conditions. The 'increase in valuation' can be nominal as in a price that goes 'higher' without a corresponding increase in value, or a decline in the value underlying the asset while the price remains nominally the same. (note 1)

True bubbles almost always involve some element of secrecy, a cover up, and some dispensation from common knowledge and experience. There are almost always dissenters, voices of warning, that are ignored and even ostracized. "It's different this time..." without there being an identifiable difference, only the self referential rationale.

Stocks are not a bubble because they are going higher and the market is infallible. Housing cannot be a bubble because the housing market is so geographically diverse. You get the point. Not all things that increase in price are a bubble, but this does not mean that bubbles cannot be identified. They can, but when they serve some greater end, the voices of dissent are overwhelmed. Almost all bubbles involve control frauds and the corruption of the media, the analysts, and the regulators, to some degree, through benefits and intimidation.

When the artificial conditions are removed the valuation of the bubble 'reverts to the mean, ' a more normal valuation based on the fundamentals, unadjusted and undistorted supply and demand. An asset bubble often involves a fraudulent design taking advantage of and even perpetuating a corresponding foolishness. In other words, the fraud is father to the folly.

The duration of a bubble does not make it valid or 'the new normal.' Like most chronic conditions it just means that the adjustment will be all the more difficult.

The US dollar as the world's reserve currency, and the unusual period of US prosperity, is an historical artifact of the post World War II era that will not continue indefinitely. When the reversion to the mean occurs, it is likely that the dollar will have to be reissued as 'the new dollar' similar to the rouble in the post-Soviet adjustment. I can think of few better examples of what the US faces than the collapse of the former Soviet Union. For the UK, it looks like Argentina, or Iceland writ large, but with the sharp edge of a police state.

A bubble is a significant increase in valuation supported by a set of artificial, inexplicable, and otherwise unsustainable conditions. The 'increase in valuation' can be nominal as in a price that goes 'higher' without a corresponding increase in value, or a decline in the value underlying the asset while the price remains nominally the same. (note 1)

True bubbles almost always involve some element of secrecy, a cover up, and some dispensation from common knowledge and experience. There are almost always dissenters, voices of warning, that are ignored and even ostracized. "It's different this time..." without there being an identifiable difference, only the self referential rationale.

Stocks are not a bubble because they are going higher and the market is infallible. Housing cannot be a bubble because the housing market is so geographically diverse. You get the point. Not all things that increase in price are a bubble, but this does not mean that bubbles cannot be identified. They can, but when they serve some greater end, the voices of dissent are overwhelmed. Almost all bubbles involve control frauds and the corruption of the media, the analysts, and the regulators, to some degree, through benefits and intimidation.